Sales territory planning is the art and science of dividing your market into balanced, manageable patches for your sales reps. I say "art and science" because it’s not just about drawing lines on a map. It's about building the very foundation for predictable revenue, keeping your sales team fired up, and making sure you're covering every inch of your market.

Why Strategic Territory Planning Matters Now More Than Ever

I've seen it time and time again: companies treat territory planning like a chore. It's an administrative task they dust off once a year and quickly check off the list. Frankly, that’s a costly mistake. It's one of the most powerful strategic levers a sales organization can pull, impacting everything from top-line revenue to sales rep retention.

When you don't have a thoughtful plan, chaos is right around the corner.

You end up with reps managing wildly unbalanced territories. One salesperson is drowning in a sea of high-potential accounts they can't possibly get to, leading to neglected customers and huge missed opportunities. Meanwhile, another rep is stuck in a barren territory, struggling to make quota and feeling like they were set up to fail.

This imbalance isn't just frustrating for your team; it's a direct leak in your revenue bucket. It creates internal friction and what we call "sales cannibalization," where reps accidentally trip over each other, chasing the same leads because the boundaries are murky.

The True Cost of Neglecting Your Territory Plan

Letting your territory plan gather dust creates a domino effect of problems that silently chip away at your bottom line. These issues only get worse—and harder to fix—the longer you ignore them.

A few classic problems I see from poor planning include:

- Sky-High Sales Rep Burnout: When territories are a mess, reps with overloaded patches work themselves to the bone for diminishing returns. Those with sparse territories just lose motivation. This is a primary driver of costly sales team turnover.

- Inefficient Resource Allocation: Your top-performing reps might be wasting their talent in low-potential areas, while you throw developing reps into complex territories without the support they need to succeed.

- Completely Skewed Performance Metrics: Unbalanced territories make it impossible to know who's actually a good salesperson. Is a rep underperforming because of their skills, or is it because their territory has 50% less potential than their peer's? You can't tell.

A well-designed sales territory plan is the bedrock of a high-performing sales team. It transforms random effort into focused, strategic action, ensuring every customer gets the right attention and every rep has a fair shot at success.

The Data-Driven Advantage in Modern Planning

Now for the good news. Getting this right pays off—big time. Companies that nail their territory strategy can see up to a 15% increase in revenue and a 20% jump in sales productivity. That’s a massive lift compared to teams using outdated, "gut-feel" methods.

What’s more, a data-backed approach can slash the time you spend on the planning process itself by as much as 75%.

Despite these clear wins, a shocking number of organizations are still flying blind. Only 39% of companies are properly pulling in data from their CRM, ERP, and other market intelligence tools. This leaves huge gaps in their strategy that sabotage performance before reps even make their first call. You can learn more about how crucial data integration is for sales planning on Abacum.ai.

Ultimately, smart territory planning shifts your team from a reactive, firefighting mode to a proactive, strategic one. It’s the difference between hoping your team hits its numbers and building a system where success becomes a predictable outcome. When you treat it like the strategic imperative it is, you build a fair, motivated, and ruthlessly efficient sales force ready to own its market.

Gathering and Preparing Your Core Territory Data

Let's be blunt: a world-class sales territory plan is built on a foundation of clean, reliable data. Full stop. If your data is a mess—fragmented, inaccurate, or incomplete—the entire structure you build on top of it will be wobbly at best. The old saying "garbage in, garbage out" has never been more true than in sales territory planning.

This isn't just about exporting a customer list from your CRM. Think of yourself as a detective. You're gathering clues from different sources to solve the puzzle of how to best deploy your sales resources for maximum impact. It's a deliberate effort to assemble a complete, accurate picture of your market, your customers, and your team's real-world performance.

Starting with Your Internal Data Goldmine

Your most valuable information is probably hiding in plain sight, scattered across the very systems you use every day. The trick is knowing what to look for and how to stitch it all together. Before you even glance at external market reports, you need to conduct a thorough audit of your own internal assets.

Your primary sources of truth are likely:

- Customer Relationship Management (CRM): This is your command center. It holds the nitty-gritty on account histories, contacts, past sales activities, and deal stages.

- Enterprise Resource Planning (ERP): This is where the money is. Your ERP tracks the hard numbers—actual sales figures, product margins, and customer lifetime value (CLV).

- Marketing Automation Platform: This system tells you where your best opportunities come from, containing crucial intel on lead sources, engagement levels, and conversion rates.

The real challenge? These systems often don't speak the same language. Your first task is to bridge that gap and create a single, unified view. You need to see a customer's entire journey, from the moment they became a lead to their latest purchase.

The Essential Data Points for Your Audit

As you start pulling everything together, you need to focus on metrics that will directly shape your territory design. Just looking at total revenue per account won't cut it. We need to dig deeper to understand the potential and efficiency hiding in your market.

Here’s a practical checklist of data points I always gather for a robust analysis:

- Historical Sales Performance: Pull revenue and profit data by account, zip code, and existing territory. Look back at least 12-24 months to spot established strongholds and, just as importantly, areas of weakness.

- Customer Lifetime Value (CLV): Which accounts are your long-term partners, not just one-off wins? High-CLV customers are strategic assets and might need a different level of attention.

- Lead Conversion Rates by Source: Do leads from that trade show in Q2 or from organic search convert at a higher rate? This is a core part of effective B2B sales lead generation and can point you to untapped goldmines.

- Sales Cycle Length: How long does it actually take your team to close a deal in different regions or industries? A territory with a chronically long sales cycle can't support as many active accounts.

- Product Mix Penetration: Are you crushing it with Product A in the Northeast but can't give it away in the Southwest? This could signal a huge cross-sell opportunity or the need for a rep with specialized knowledge.

Key Insight: Don't just analyze your wins. I’ve learned more from our losses than our victories. Spend just as much time figuring out where and why you lose deals. This is invaluable intel for structuring territories to be more competitive.

This internal audit gives you a clear baseline—the ground truth of your business today. It shows you what’s worked in the past and where your strengths are. This is the bedrock you'll build on.

Layering in External Market Intelligence

With your internal data cleaned up and making sense, it’s time to look outside your own four walls. External data gives your internal numbers the market context they're missing. It helps you build a forward-looking plan based on real opportunity, not just past performance.

Think of this step as understanding your Total Addressable Market (TAM) and spotting the external forces that could help or hinder your sales team. It keeps you from designing territories in a vacuum.

To enrich your analysis, start pulling in these external data sets:

- Industry and Firmographic Data: Use tools like LinkedIn Sales Navigator or ZoomInfo to get a hard count of the potential target companies in a given area. How many logos that fit your Ideal Customer Profile are actually in that zip code?

- Competitor Saturation: Where are your competitors’ offices? Where are their sales reps most active? Knowing this helps you find underserved markets to attack or overly-crowded ones to avoid.

- Regional Economic Indicators: Simple things like local GDP growth, employment rates, or news of a new business park opening can be powerful signals of an emerging hot spot.

When you merge this external intelligence with your internal performance data, you shift from a reactive to a proactive planning model. Now you can design territories based not just on where you've been, but on where the greatest future opportunities lie.

Designing Territories with Intelligent Segmentation

Once your data is clean and consolidated, the real fun begins: designing the actual territories. This is the moment where raw numbers and market intel get molded into a strategic blueprint for your sales team.

Frankly, just drawing circles on a map is an outdated approach. It's a classic mistake. A territory covering a massive rural area might have the same number of potential accounts as one spanning three dense city blocks, but the opportunity and workload are worlds apart. You end up with one rep drowning in windshield time and another overwhelmed with prospects.

The goal isn't territories that are equal in square mileage, but territories that are equitable in potential.

This is where you strategically carve up your total addressable market (TAM). Instead of just looking at geography, you'll slice it by things like industry, account size, or even which products they're likely to buy. Doing this focuses your sales team's energy where it counts—on high-value regions and prospects. Good territories let reps dig in and build real relationships, which boosts both new customer wins and long-term retention. For a deeper look at this, Drivetrain.ai has some great insights on segmentation strategies.

Beyond Geography: Finding the Right Segmentation Model

To build a plan that actually works in the field, you need to layer different segmentation models. Think of it as creating a multi-dimensional view of your market. This is how you get to truly smart territory design.

Here are a few of the most effective models I’ve seen work:

- Industry Vertical: Grouping accounts by industry (fintech, healthcare, manufacturing) lets reps become genuine subject matter experts. A rep who speaks the language of financial services and understands its unique triggers will always outperform a generalist.

- Account Size: This is a classic for a reason. Splitting territories into tiers like Small-to-Medium Business (SMB), Mid-Market, and Enterprise makes perfect sense. The sales cycle, deal complexity, and skills needed to close a $5,000 SMB deal are completely different from what it takes to land a $500,000 enterprise contract.

- Product Line Specialization: If your portfolio includes diverse or highly technical products, you might need reps who specialize. This ensures your most complex offerings are sold by people who can confidently handle deep technical questions without fumbling.

- Customer Potential: This is a more advanced move. It means prioritizing accounts based on their potential lifetime value, not just their current spending. You identify accounts ripe for cross-selling or upselling and assign your top reps to nurture those relationships for long-term growth.

Before we dive into how to combine these, let's compare them side-by-side. Each model serves a different purpose, and knowing the potential pitfalls is just as important as knowing the benefits.

Comparison of Sales Territory Segmentation Models

| Segmentation Model | Primary Metric | Best For | Potential Challenge |

|---|---|---|---|

| Geographic | Location, Proximity | Field sales teams, reducing travel time and costs. | Can create massive imbalances in workload and opportunity if not layered. |

| Industry Vertical | Industry Classification (NAICS/SIC) | Companies with industry-specific solutions or compliance needs. | Reps may need significant training to become true experts. |

| Account Size | Revenue, Employee Count | Businesses with distinct sales cycles for different customer tiers. | Misclassifying accounts can lead to mismatched rep skills and lost deals. |

| Product Line | Product/Service Knowledge | Companies with complex, technical, or diverse product portfolios. | Can create silos and may not be efficient for smaller sales teams. |

| Customer Potential | Lifetime Value (LTV), Upsell Opportunity | Nurturing high-growth accounts and maximizing customer value. | Requires sophisticated data analysis to accurately predict potential. |

As you can see, there’s no single "best" model. The real power comes from combining them to create a hybrid approach that fits your specific business.

Building a Hybrid Segmentation Model: A Real-World Scenario

Let's walk through a practical example. Imagine you're a fintech company selling a sophisticated compliance software suite. Your market is huge—everything from two-person startups to global banking giants. A simple geographic plan would be a total mess.

So, you build a hybrid model.

First, you start with major geographic hubs. You identify the key financial centers—New York, London, Singapore. These are your foundational pillars.

Next, you layer on account size. Within each hub, you create sub-territories. You might have one rep focused exclusively on Enterprise accounts in Manhattan's financial district. At the same time, another rep could handle SMB accounts in a much wider territory covering the surrounding suburbs.

Finally, you consider potential in emerging markets. For a region like the Southeastern U.S., which has a few growing financial hubs but is less dense, you might give a single rep a very large geographic area. But their job isn't to cold-call everyone. Instead, they'd focus on a curated list of high-potential accounts.

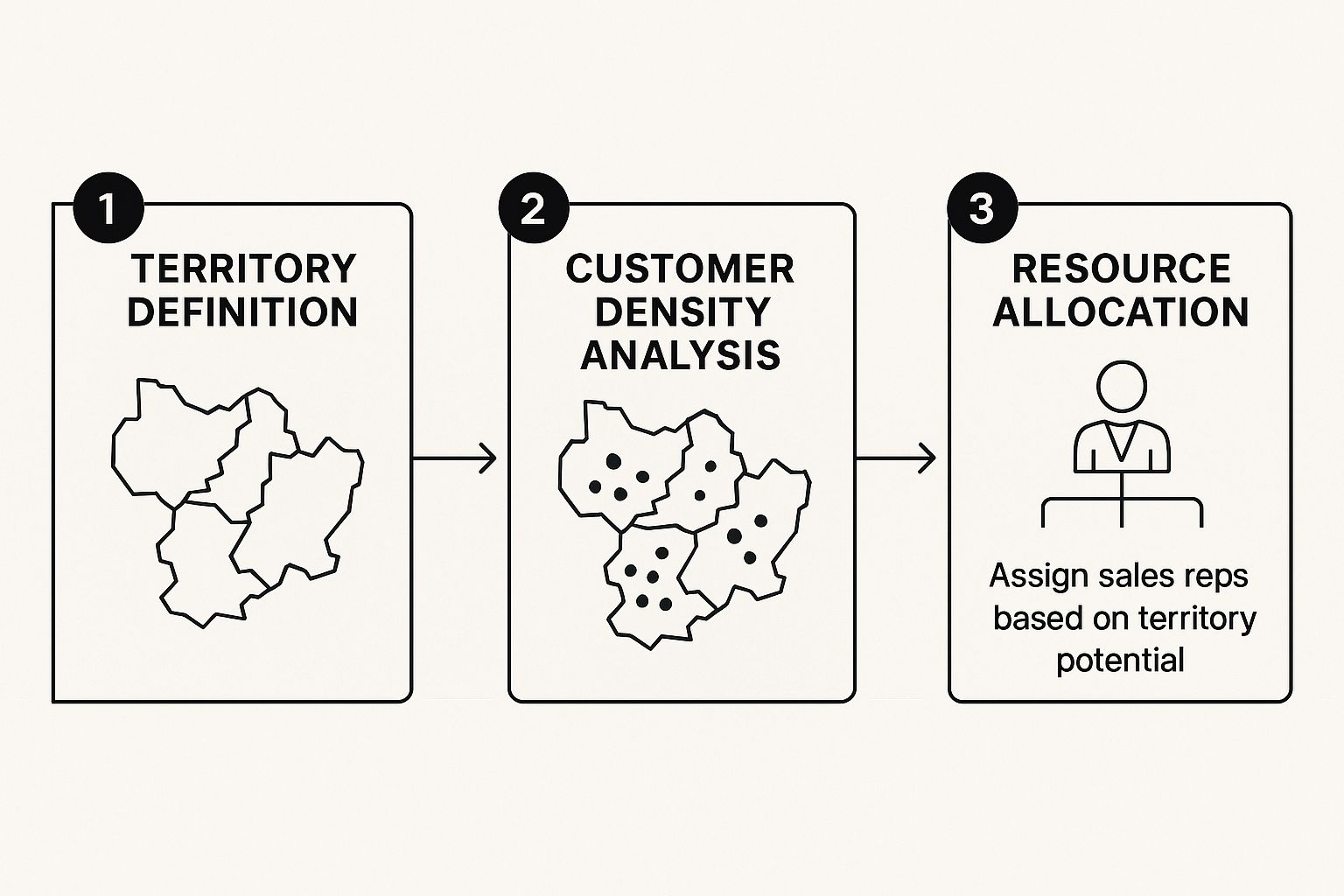

This infographic breaks down how you turn raw data into smartly allocated resources.

This flow shows how you move from abstract definitions to data-driven analysis, ultimately assigning reps based on real territory potential, not just lines on a map.

This hybrid approach ensures your reps' skills are perfectly matched to their accounts. Your seasoned enterprise reps focus on closing complex, high-value deals without getting sidetracked by small, transactional sales. Meanwhile, your SMB reps can efficiently manage a higher volume of deals with shorter cycles.

What's the result? A focused, efficient, and motivated sales team where everyone has a clear and equitable path to hitting their number. That’s the heart of modern sales territory planning.

Using Modern Tools for Territory Mapping

Trying to manage sales territory planning with a spreadsheet these days is a losing game. It’s like using a folded paper map from your glovebox to navigate rush hour traffic—you'll get somewhere, eventually, but you'll be slow, inefficient, and blind to a dozen better routes.

Modern sales territory mapping software has completely changed the game. Forget simple pin-on-a-map tools.

Think of these platforms as powerful analytic engines that turn raw data into a visual strategy. Instead of getting lost in endless rows of numbers, you can instantly see where your best opportunities are clustered, spot underserved markets, and catch where your reps are accidentally tripping over each other.

The real magic is in their ability to model "what if" scenarios on the fly. What happens if we hire two more reps? What if we pivot to focus on the manufacturing sector? Instead of guesswork and gut feelings, you can build and compare different territory models in minutes, seeing the exact impact on rep workload and potential revenue before committing.

Must-Have Features in Mapping Software

When you're shopping around for a tool, a few features are non-negotiable. These are the things that separate a basic digital map from a true strategic asset that actually drives performance.

Make sure any platform you consider offers:

- Advanced Data Visualization: You need to be able to layer multiple data sets—think customer locations, deal sizes, lead sources—onto one interactive map. This is how you spot patterns you'd never see in a spreadsheet.

- Real-Time Performance Dashboards: Your territory plan isn't a "set it and forget it" document. You need live dashboards showing quota attainment, activity levels, and sales velocity by territory so you can make quick, smart adjustments.

- Route Optimization: This is a lifesaver for any field sales team. The software should automatically calculate the most efficient daily routes, slashing drive time and giving reps more hours to actually sell.

- Seamless CRM Integration: Your mapping software has to sync flawlessly with your CRM. It's a two-way street: account data needs to be current in the map, and any territory changes you make need to be pushed back to the CRM instantly.

Putting Mapping Tools into Practice

Let's walk through a real-world situation. One of your top reps just put in their notice. In the old days, this meant a frantic scramble to manually reassign accounts, almost guaranteeing some customers get dropped and other reps get overloaded.

With a proper mapping tool, the process is clean and strategic.

The sales manager can pull up the departing rep’s territory and see every single account, color-coded by value. They can then select that entire book of business and let the software automatically redistribute the accounts to the surrounding reps, balancing the new territories based on each rep's current workload and geographic focus.

This data-first approach lets you rebalance territories with basically zero disruption. When it comes to managing these processes effectively, it's worth seeing how powerful CRM solutions like Salesforce can act as the central hub for your territory data.

Pro Tip: Don't sleep on heat maps. Use them to find clusters of high-value prospects or existing customers. You might just uncover a "hidden" territory that's dense enough to justify its own dedicated rep, even if the geographic area is small.

Ultimately, these platforms should plug right into your broader sales strategy. By integrating with your key systems, you make sure every lead, interaction, and deal is tracked within its proper territory context. As you build out your tech stack, check out our guide on the top sales engagement platforms to see how these tools can work together to create a seamless workflow for your entire team.

Putting Your New Territory Plan into Action

Let's be honest. Even the most brilliant, data-driven sales territory plan is just a document until you bring it to life. The real test begins now, during the rollout and ongoing management. This is where your strategic blueprint smacks into the real world.

I’ve seen it happen: months of careful planning get completely undermined by a clumsy launch. You end up with confusion and resistance instead of clarity and motivation.

An amazing plan is worthless without a great launch. Success comes down to clear communication, keeping a close eye on performance, and treating your plan like a living, breathing part of your sales strategy. This isn't a "set it and forget it" task. It's the start of a continuous cycle of improvement.

Handling the Rollout with Transparency

The moment you announce new territories is critical. Your team's initial reaction will set the tone for everything that follows. Sales reps are naturally protective of their accounts—they’ve built those relationships. Any change can feel like a threat if it's not handled with care. The secret? Be transparent, let the data do the talking, and show some empathy.

Before the big reveal, get your communication plan locked down. Don't just fire off an email with a spreadsheet of new assignments. That’s a recipe for disaster. Instead, schedule a team meeting where you can walk everyone through the why behind the new map.

Here’s a simple way to structure that conversation:

- Acknowledge the Past: Start by recognizing the team's hard work under the old structure. Validate their efforts.

- Explain the "Why": Clearly lay out the business goals. Are you trying to improve market coverage, balance workloads, or tap into new growth areas? Show them the data you used to make these calls.

- Show, Don't Just Tell: Fire up your mapping software and visually present the new territories. When people can see the logic, it becomes tangible and much easier to accept.

- Answer "What's In It For Me?": Frame the changes in terms of benefits for them. Maybe it's a more equitable shot at quota, less windshield time, or a laser focus on high-potential accounts.

- Prepare for Questions: Dedicate real time to a Q&A. Be ready to have one-on-one conversations to address individual concerns privately.

The goal of the rollout isn't just to inform; it's to get buy-in. When reps understand the new sales territory plan was designed to make them more successful, they're far more likely to jump on board.

Tracking Performance and Creating a Feedback Loop

Once the new territories are live, your job pivots to monitoring and managing. You have to know if the plan is actually working. This means tracking the right metrics and, just as importantly, creating a way for your reps to tell you what they're seeing out in the field.

First, set up a core dashboard of Key Performance Indicators (KPIs) for each territory. This will be your single source of truth, showing you where the plan is crushing it and where it needs a tune-up.

A few essential metrics to keep on your radar:

- Sales per Territory: The most basic measure. Is revenue hitting your projections?

- Quota Attainment Rate: Are reps hitting their numbers? If one territory is consistently missing, it might be a flaw in the plan, not the person.

- Customer Acquisition Cost (CAC): How much are you spending to land a new customer in each territory?

- Average Deal Size: Does the deal size align with the types of accounts you assigned to that territory?

- Sales Velocity: How quickly are deals moving through the pipeline in different areas?

But data only tells you half the story. The other half comes from qualitative feedback. Your reps are your eyes and ears on the ground.

Set up a formal feedback loop—whether it's during your weekly one-on-ones or a dedicated monthly check-in. This is their chance to share intel on competitor moves, new customer needs, or opportunities you never saw coming. This ground-level intelligence is priceless for keeping your plan connected to reality.

Setting a Cadence for Review and Adjustment

Markets change. Competitors make moves. Your company’s strategy evolves. A static territory plan will quickly become a relic. It has to be flexible enough to adapt.

To make sure your plan stays relevant, define a regular schedule for review and adjustment.

For most teams, a quarterly review is a good rhythm. It's frequent enough to catch problems before they spiral out of control, but not so often that you’re constantly creating chaos. In these reviews, you'll dive into your performance dashboards and hash out the feedback from the team.

You also need an annual deep dive. This is a much bigger reassessment, similar to your initial planning process. You'll re-evaluate your total addressable market, analyze a full year of performance data, and make larger structural changes if they're needed. This ongoing process of refinement is the key to long-term success and is a core part of any effective sales process optimization strategy.

Common Sales Territory Planning Questions

Look, even with the most solid framework, you're going to hit some bumps and have questions pop up during territory planning. It’s totally normal. Let's tackle some of the most common hurdles I see teams face. Getting clarity on these points upfront can save you a ton of headaches later and help you build a plan your team can actually execute with confidence.

Think of this as your go-to guide for navigating those tricky spots that can derail an otherwise solid planning session.

How Often Should We Review Our Territory Plan?

This is easily one of the most critical questions I get asked. The honest answer? It depends on your market, but "set it and forget it" is a recipe for disaster.

As a general rule, you absolutely need to conduct a full, deep-dive review at least once a year. This usually lines up nicely with your annual business planning and budgeting cycle.

But don't stop there. You should also schedule lighter quarterly check-ins. These aren't about blowing everything up and starting over. Instead, use this time to:

- Dig into your performance dashboards and KPIs.

- Get real, on-the-ground feedback from your reps about what's working and what isn't.

- Make small, smart adjustments to account for market shifts or team changes.

And then there are the trigger events. Things like a major product launch, a big pivot in company strategy, or a merger/acquisition should prompt an immediate review, no matter where you are in your annual cycle.

How Do We Balance Territories for Fairness and Workload?

This is where art meets science. True balance in sales territory planning has nothing to do with giving every rep the same number of accounts or the same zip codes. It’s all about giving everyone an equal opportunity to crush their quota. To do that, you have to move beyond simple metrics and create a weighted model.

When you're trying to balance territories, think about these factors:

- Account Potential: Don't just look at what an account spent last year. What's its potential for growth, upsells, and cross-sells?

- Travel Time: A dense urban territory with 100 accounts is a completely different beast than a sprawling rural one with the same number. Use your mapping tools to estimate "windshield time"—it's a real factor.

- Account Complexity: An enterprise account with a nine-month sales cycle and a dozen stakeholders is way more demanding than a quick, transactional SMB deal.

- Lead Flow: Is one territory getting a firehose of high-quality inbound leads while another is a barren wasteland? That has to be factored in.

A territory is balanced when each rep has a fair shot at hitting their quota if they put in the right amount of smart effort. The goal is equitable opportunity, not identical territories.

How Should We Handle New Hires or Rep Turnover?

Turnover is just a fact of life in sales. Your territory plan needs to be flexible enough to handle it without descending into chaos. When a rep leaves, the last thing you want is a frantic, manual scramble to reassign their book of business. This is where a modern mapping tool really proves its worth.

Your process should be simple: immediately visualize the vacant territory and see how it fits with the surrounding areas. The software can help you model a few scenarios for redistributing those accounts based on the current workload and physical proximity of the neighboring reps.

When a new hire comes on board, resist the urge to throw them into the deep end with your most challenging or underserved territory. A much better strategy is to assign them to a stable, well-defined patch with a healthy mix of existing customers and fresh prospects. This lets them build confidence and really learn your sales process before you ask them to take on a bigger challenge. Making sure the plan is clearly documented in your CRM makes this entire handoff process so much smoother.

Ready to build and manage a high-performing outreach strategy based on your new territories? Salesloop.io makes it easy to segment prospects, create targeted campaigns, and automate follow-ups to turn your plan into predictable revenue. Scale your B2B lead generation and accelerate pipeline growth by visiting Salesloop.io today.