At its heart, calculating Return on Investment (ROI) is pretty simple. You take the total gain from an investment, subtract what you spent on it, and then divide that number by your total cost.

The result, usually shown as a percentage, tells you just how profitable any move you make is—whether that’s a big marketing campaign or a new piece of tech.

Understanding What ROI Really Tells You

Before you get lost in the numbers, it's crucial to understand what ROI actually means. It’s a powerful, no-nonsense measure of profitability. It cuts through all the noise to answer one simple, vital question: "For every dollar we put in, how many dollars did we get back?"

Think of it as the universal language for business performance. It lets you compare totally different initiatives on a level playing field. For example, you can use ROI to figure out if it’s smarter to invest in a new sales outreach platform or pour that money into a social media ad campaign. Without it, you're just guessing where your budget will have the biggest impact.

The Core Components of the ROI Formula

To get ROI right, you have to nail its two main parts: Net Profit (your gain) and Total Investment (your cost). If you mess up either of these, your results will be way off, and you could end up making some seriously bad decisions.

A classic mistake is only counting the obvious costs. When you buy new software, the "investment" isn't just the price tag. It’s also the hours your team spends in training, any integration fees, and the recurring subscription costs.

Likewise, the "gain" isn't always just fresh revenue. It could be cost savings from making your team more efficient or even higher customer retention that boosts lifetime value.

The formula itself is straightforward. Let’s say you invest $10,000 into a project. After accounting for all expenses, it brings in $12,800. Your ROI would be 28%. That simple calculation tells you the initiative was a win. For a deeper dive into the fundamentals and more examples, check out this overview of ROI principles.

Key Takeaway: A positive ROI means you made more than you spent. A negative ROI means you lost money. It’s that clear-cut outcome that makes this metric so essential for smart planning and deciding where to put your resources.

Why Accurate ROI Measurement Is Non-Negotiable

Knowing how to measure ROI isn't just some accounting chore—it's a strategic must-do. When you track it consistently and accurately, you can justify your budget requests, fix underperforming channels, and confidently double down on what’s actually working.

It moves your decision-making from "gut feelings" to being backed by hard data.

Ultimately, getting a firm handle on ROI helps you build a more resilient and profitable business. It ensures every single dollar you spend is working as hard as possible for you.

Getting the Real Story on Costs and Returns

Any ROI calculation is only as good as the numbers you feed it. If you're only looking at the obvious, surface-level figures, your final number will be misleading. It’s a common trap.

To get a real handle on the ROI of any project, you have to dig a bit deeper. You need to capture the entire financial picture, warts and all.

The real cost of an investment is almost never just the purchase price. There are always other expenses lurking beneath the surface—"hidden" costs that can tank your ROI if you ignore them. Overlooking these is one of the fastest ways to inflate your perceived returns and make a bad decision.

Let's say you're bringing in a new sales outreach platform. That initial invoice is just the tip of the iceberg.

Uncovering the Total Cost of Your Investment

To get a true sense of what you’re spending, you need to add up every single related expense. This means tallying up both the one-time costs to get started and all the ongoing expenses that stick around for the life of the tool.

A proper list usually includes things like:

- Direct Purchase Price: This is the easy one—the sticker price for the software or service.

- Setup and Implementation: Don't forget any one-time fees for professional services, getting your data moved over, or system configuration.

- Staff Training Time: This one’s huge. You have to calculate the cost of your team's time spent learning the new system instead of doing their actual jobs. If five people spend a full day in training, that’s 40 hours of productivity you've just spent.

- Ongoing Subscriptions: Those recurring monthly or annual fees are a big part of the long-term cost.

- Maintenance and Support: Factor in any paid support plans or the time your own IT crew will spend keeping things running.

When you add all this up, you get your true Total Cost of Investment. This is the number that belongs in the denominator of your ROI formula, and it stops you from patting yourself on the back for a success that isn't real.

Identifying the Full Spectrum of Returns

Just like costs, returns can also be hidden in plain sight. The "gain" from an investment isn't always as simple as a bump in direct revenue. In my experience, some of the most powerful returns come from making your operations smoother and gaining a long-term strategic edge.

If you ignore these, a genuinely game-changing project can look like a total flop on paper.

Key Insight: A narrow focus on immediate revenue is a critical error in ROI analysis. True gains often include efficiency improvements, cost savings, and enhanced customer value, all of which must be quantified.

Think about that same sales platform. The return isn't just about the new deals it helps close. You should also be looking at:

- Increased Productivity: What if the new tool automates tasks and saves each rep five hours a week? That's time they can now spend on actual selling. That efficiency gain has a very real dollar value.

- Better Customer Retention: A smoother outreach process often leads to happier clients and less churn. Here’s a stat for you: a 5% increase in customer retention can crank up profitability by 25% to 95%. That's a massive return right there.

- Reduced Operational Costs: Maybe this new platform lets you cancel subscriptions for two or three older, clunkier tools. That's direct cost savings you can take straight to the bank.

Getting these nuanced calculations right is especially important for complex B2B sales and marketing efforts. If you're in marketing, checking out some marketing automation ROI secrets from industry veterans can give you a solid roadmap for attributing value where it's due.

The goal is to translate every single positive outcome—from saved time to happier customers—into a hard financial number.

Calculating ROI for Marketing and Sales Campaigns

Figuring out the return on your marketing and sales efforts can feel like chasing a moving target. It’s not always a straight line. With long sales cycles and prospects interacting with your brand across multiple channels, it’s a lot trickier than a simple investment calculation.

But this is exactly why getting a handle on ROI is so critical. It turns your campaigns from a cost center into a predictable growth engine.

The trick is to use modern attribution methods that actually connect your spending to the revenue it brings in. This means you have to go beyond surface-level metrics. We're talking about using tools like UTM parameters, CRM data, and analytics to see the entire customer journey from start to finish.

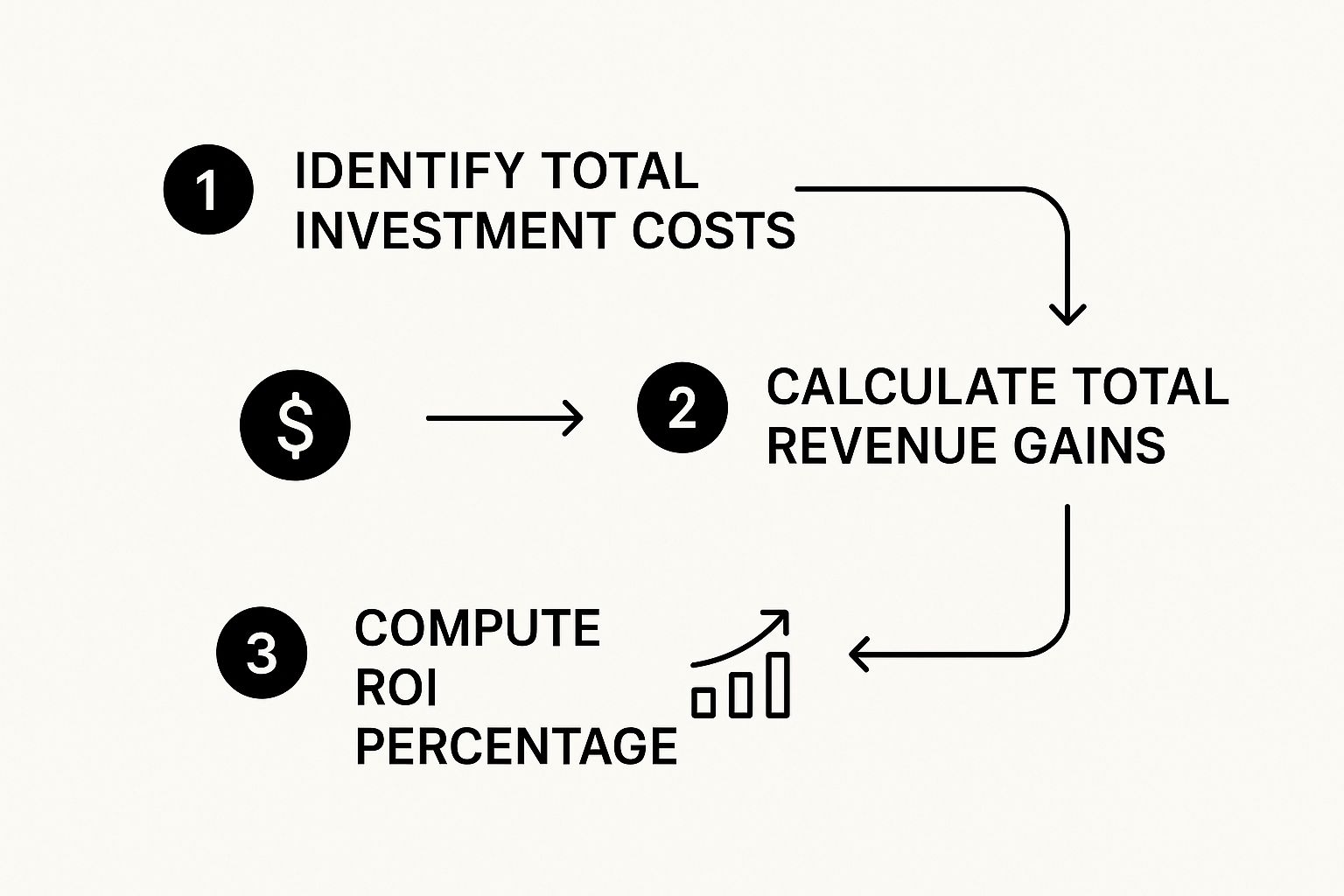

This visual flow breaks down the simple, three-step process for figuring out the return on any marketing or sales initiative.

As you can see, the process hinges on capturing all your costs first, then linking them directly to the revenue gains before you get to that final percentage.

From Ad Spend to Closed Deals

Let’s walk through a real-world scenario. Imagine you run a LinkedIn ad campaign to promote a new guide. The goal isn't just to get a bunch of downloads—it's to generate qualified leads that your sales team can actually turn into customers.

To measure the ROI accurately, you need to track every single step.

First, you have to tally up your total investment. This isn’t just the ad budget. It includes:

- Ad Spend: The direct cost of running the ads on LinkedIn.

- Content Creation: The time and resources that went into creating the guide itself.

- Team Hours: The time your team spent managing the campaign and following up with the leads that came in.

Next up, you track the returns. By using UTM parameters on your ad links, you can see exactly which leads came from this specific campaign. As those leads move through your CRM and eventually become paying customers, you can attribute that new revenue directly back to your initial investment.

If you want to go deeper on this, here's a great resource to help you calculate marketing ROI that actually drives profit.

Setting Your ROMI Benchmarks

Once you've got your numbers, you can calculate your Return on Marketing Investment (ROMI). The great thing about modern online marketing is that it's easier than ever to track customer engagement, from the very first click to the final sale.

So, what does a "good" ROMI actually look like?

Industry pros generally see a ROMI ratio (total revenue / marketing costs) of 5:1 as strong. A 10:1 ratio is exceptional, while a 2:1 ratio might mean a campaign is just barely breaking even once you factor in the cost of goods sold and other business expenses.

These benchmarks give you a clear yardstick to measure your own performance against. For example, if you invested $5,000 in that LinkedIn campaign and it brought in $25,000 in new business, your 5:1 ROMI is a solid win.

Applying ROI to Content Strategy

ROI isn't just for paid ads. It's just as important for long-term strategies like content marketing.

While the impact from content can take longer to show up, the measurement principles are the same. A key part of your investment, for instance, is actually promoting the content you create. If you're looking for ideas, we have a detailed guide that shows you how to promote your content using LinkedIn.

By tracking which blog posts, guides, or webinars are sourcing the most qualified leads, you can double down on the topics that truly resonate with your audience and drive real business results. This kind of data-driven approach ensures your marketing budget is always working its hardest for you.

Choosing the Right Tools to Track Your ROI

If you're still wrestling with spreadsheets to calculate ROI, you're making life harder than it needs to be. Manual data entry is not just a headache; it's a recipe for costly mistakes. In a complex B2B sales world, where a dozen touchpoints can influence a single deal, trying to track everything by hand is like flying blind.

The right software changes the game. It automates the whole process, pulling all your cost data into one place and connecting it directly to revenue. It’s about replacing guesswork with a clear, real-time picture of what's actually driving growth.

Integrating Your Tech for a Clearer Picture

The absolute key to getting ROI measurement right is establishing a single source of truth. It's a classic problem: your marketing platform, sales tools, and CRM don't talk to each other. When that happens, your data lives in separate silos, making it nearly impossible to trace a customer's journey from their first click to the final handshake.

Modern tools are built to tear down these walls. For instance, a solid CRM like Salesforce can become your command center, pulling in data from marketing automation platforms like HubSpot and other specialized analytics tools.

When your tech stack is integrated, you can finally see:

- Lead Source Attribution: Instantly pinpoint which campaigns are delivering the most valuable leads.

- Pipeline Velocity: Understand how quickly marketing-generated leads are cruising through your sales cycle.

- Full Journey Mapping: Connect every single interaction—from an ad click to a demo to a sales call—to the revenue it helped create.

Getting your systems in sync gives you that clean, end-to-end view of performance. This isn't just nice to have; it's essential if you want to know how to measure ROI correctly.

Comparing Popular ROI Tracking Tools

Every business has different needs, so the "best" tool really depends on your team's size, the complexity of your sales process, and what you're trying to achieve. There are tons of options out there, each with its own strengths.

Expert Tip: Don't just hunt for a tool that spits out an ROI number. You need a tool that delivers actionable insights. The goal isn't just knowing the number; it's understanding the why behind it so you can make smarter moves.

To help you get started, here’s a quick breakdown of the main tool categories and what they bring to the table for ROI tracking.

Comparison of ROI Tracking Tools

| Tool Category | Primary Function | Key Features for ROI | Example |

|---|---|---|---|

| CRM Platforms | Manages customer relationships and sales pipelines. | Tracks deals from lead to close, attributes revenue to specific campaigns. | Salesforce |

| Marketing Automation | Automates marketing tasks and nurtures leads. | Provides detailed campaign analytics, lead scoring, and journey mapping. | HubSpot |

| B2B Analytics | Focuses on B2B-specific attribution and analytics. | Offers multi-touch attribution models and connects marketing data to revenue. | HockeyStack |

Ultimately, what matters most is choosing a tech stack that automates the grunt work of data collection. You want your tools to serve up the numbers in clean, easy-to-read dashboards.

This frees up your team to do what they do best: analyze the results, find the patterns, and fine-tune your strategy instead of being buried in calculations.

Turning ROI Data into Smarter Business Decisions

Calculating your ROI is a critical first step, but the number itself is just a data point. The real value comes from what you do with that information. It’s the difference between simply knowing the score and actually using it to win the game.

Effective interpretation turns raw ROI data into a strategic compass. It shows you exactly where to put your next dollar, which campaigns to scale up, and which ones to cut loose before they drain any more resources. Without this analysis, you're just guessing, and you risk repeating the same costly mistakes.

Putting Your ROI into Context

A single ROI figure can be seriously misleading without the right context. An ROI of 15% might sound disappointing at first glance, right? But what if that investment was for a long-term brand-building campaign designed to pay off over several years? In that light, a modest initial return is actually a positive signal.

On the flip side, a huge ROI on a tiny, one-off project might not be as impactful as a moderate ROI on a large-scale, strategic initiative. You always have to weigh your results against your bigger business goals and timelines.

Consider these contextual factors before jumping to conclusions:

- Investment Timeline: Is this a short-term tactical play or a long-term strategic investment? Long-term projects often have lower initial ROI but can deliver massive cumulative returns down the road.

- Business Goals: Does the ROI support a key objective, like breaking into a new market or improving customer retention? Sometimes, a lower ROI is perfectly acceptable if it moves the needle on a critical strategic goal.

- Risk Level: High-risk, high-reward ventures are naturally going to have a different ROI profile than safer, more predictable investments.

Understanding the bigger picture keeps you from making knee-jerk decisions based on a number in isolation. A low ROI isn't always a failure, and a high one isn't always a repeatable success.

A fascinating study of global returns from 1870 to 2015 really helps ground our expectations. It found residential real estate yielded a mean annual real return of 7.05%, just edging out equities at 6.89%. Knowing historical benchmarks like these helps keep your own ROI targets rooted in reality. You can dig into these long-term investment findings to see how different asset classes perform over time.

From Analysis to Actionable Strategy

Once you understand the context, it's time to act. Your ROI data is the ultimate tool for justifying budgets, reallocating resources, and fine-tuning your overall strategy. The key to getting buy-in from stakeholders is presenting your findings clearly.

Use your data to build a compelling narrative. Instead of just stating that a campaign had a 3:1 ROI, explain what that actually means for the business. Frame it like this: "For every dollar we invested in this channel, we generated three dollars in revenue, proving it's a reliable engine for growth."

This approach allows you to:

- Justify Increased Budgets: Showcasing positive ROI is the single most effective way to secure more funding for successful initiatives.

- Shift Resources Confidently: When a channel consistently underperforms, you have the hard data needed to justify moving that budget to a proven winner.

- Optimize Future Campaigns: Analyze what drove the highest returns and make sure you replicate those elements in your next project.

Visualizing your data is incredibly powerful here. Using a well-structured sales KPI dashboard can help you present your ROI findings alongside other critical metrics, making it easy for anyone to see the direct impact of your efforts.

Even with a solid plan, you're going to hit some snags when you start measuring ROI in the real world. It's a process with plenty of grey areas, and it’s super easy to get bogged down in the details. Let's walk through some of the most common questions and sticking points teams run into.

One of the biggest headaches is the notoriously long and complex B2B sales cycle. A single prospect might see a blog post, attend a webinar, get a few emails, and talk to two different reps over six months before they finally sign on the dotted line. Pinning that final revenue figure to one specific, early-stage activity feels next to impossible.

How Long Should I Wait to Measure ROI?

This is a big one. You have to be patient. Measuring the return on a long-term play too early is a surefire way to get a skewed, negative number that makes you want to pull the plug. The right timeframe really just depends on what you're measuring.

- Short-Term Campaigns: If you're running a direct ad campaign on LinkedIn, for example, you can probably get a decent read on its ROI within a single quarter.

- Long-Term Investments: But for bigger things, like rolling out a new sales engagement platform or launching a content marketing strategy from scratch, you've got to let it breathe. Giving it a 6-12 month window is much more realistic to see the full picture.

Making a snap judgment can cause you to kill a great strategy right before it starts bearing fruit.

What Is a Good ROI for My Business?

There's no silver bullet answer here. What counts as a "good" ROI is completely different depending on your industry, business model, and what you were trying to achieve with the investment in the first place.

That said, some general benchmarks can give you a bit of context.

A classic rule of thumb for marketing is a 5:1 ratio—that’s five dollars back for every one dollar you put in. For something like email marketing, some studies have shown an average return as high as $36 for every $1 spent, which just goes to show how efficient it can be.

The most important thing is to create your own benchmarks. Start tracking ROI consistently across every campaign and channel. Over time, you’ll get a feel for what a great, an average, and a poor result looks like for your business, specifically.

How Do I Account for Intangible Returns?

Not every benefit from an investment shows up neatly in a revenue column. What about things like a stronger brand reputation, better team morale from using a new tool, or increased customer loyalty? These "soft" metrics feel fuzzy, but you can still find ways to quantify them.

The trick is to tie them to a concrete business outcome. Think about it this way:

- Improved Morale: Can you connect that to a drop in employee turnover? If so, you can calculate the savings from not having to constantly hire and train new people.

- Stronger Brand Perception: Maybe this leads to a higher offer acceptance rate when you're hiring. That directly lowers your cost-per-hire.

When you start translating these intangible benefits into hard financial metrics, you can build them into your ROI calculation. It gives you a much more honest and complete view of an investment’s real value.

Ready to see exactly how your sales outreach efforts translate into revenue? Salesloop.io provides detailed analytics dashboards that connect your campaigns directly to your bottom line. Take the guesswork out of your sales strategy and start making data-driven decisions today. Explore our plans at https://salesloop.io.