Figuring out your Customer Acquisition Cost (CAC) is pretty simple on the surface.It's just your Total Sales & Marketing Costs divided by the Number of New Customers Acquired over a certain time. This one number tells you exactly what you're shelling out, on average, to land each new client.

Why Your CAC Is the Ultimate Health Metric for Your Business

Let's be real—your Customer Acquisition Cost is way more than just another number to track on a spreadsheet. It's the pulse of your company's financial health and a direct reflection of how efficiently you operate. If you don't have a solid grip on your CAC, you're basically flying blind, throwing money at strategies based on gut feelings instead of hard data.

Honestly, understanding this metric is the key to both surviving and actually growing your business sustainably. It touches nearly every important part of your operations:

- Budgeting and Forecasting: It shows you exactly how much cash you need to hit your growth targets.

- Pricing Strategy: Your prices absolutely have to cover acquisition costs and still leave room for profit.

- Marketing Efficiency: It's the final report card for all your marketing campaigns and sales hustles.

- Investor Confidence: Ask any VC. They look at CAC as a primary signal of whether a business model can actually work long-term.

Think of it as a diagnostic tool for your entire go-to-market engine. A high or climbing CAC can be a red flag for a lot of things—inefficient ad spend, bad lead quality, or maybe your marketing message just isn't landing with the right people. On the flip side, a low and steady CAC is a fantastic sign that your strategies are clicking and your business is ready to scale.

Key Insight: A healthy business doesn't just get customers; it gets them profitably. Calculating your CAC is the very first step to figuring out if you're building a sustainable company or just buying revenue at a price you can't afford.

Core Components of the CAC Formula

Before you can start punching numbers into a calculator, you need to know what numbers to use. A classic mistake I see all the time is people only counting their direct ad spend. This gives you a dangerously optimistic CAC that's nowhere near reality. A true calculation has to be much more comprehensive, covering every resource you pour into winning new business.

To get the real number, you'll need to pull data from a few different places—think accounting software, your payroll system, and various marketing platforms. Here's a quick look at the essential components you'll need to get an accurate calculation.

Core Components of the CAC Formula

A breakdown of the essential costs and metrics needed to accurately calculate your Customer Acquisition Cost.

| Component Type | Examples of Costs/Metrics | Why It's Important |

|---|---|---|

| Direct Ad Spend | Costs for Google Ads, social media campaigns, content promotion, etc. | This is the most obvious cost, directly tied to specific marketing efforts aimed at acquisition. |

| Salaries | Salaries and commissions for your sales and marketing teams. | Your people are a huge investment. Forgetting their cost drastically understates your true CAC. |

| Tools & Software | Subscriptions for your CRM (like Salesloop.io), marketing automation, and analytics tools. | These platforms are essential overhead for modern sales and marketing and must be included. |

| New Customers | The total number of new paying customers acquired in the same period. | This is your denominator. It's crucial to only count new, paying customers, not leads or trial users. |

Getting these four components right is the foundation of a meaningful CAC. Miss one, and the entire calculation can lead you down the wrong path.

How to Collect the Right Data for an Accurate CAC

You’ve heard the old saying "garbage in, garbage out," right? Well, it's never more true than when calculating your customer acquisition cost. A truly insightful CAC is built entirely on the quality and completeness of your data.

If you’re only counting your obvious ad spend, you’re not getting the real picture. You’re just creating a vanity metric, and that can lead to some seriously misguided financial decisions down the road.

To get this right, you have to play detective and track down every single relevant expense. This means going beyond the easy-to-find numbers and digging into all the operational costs that keep your acquisition engine running.

Identifying All Your Acquisition Costs

First things first: you need to cast a wide net. I see it all the time—businesses stop after totaling their Google Ads and social media campaign expenses. A real CAC calculation demands a much deeper dive, pulling numbers from your accounting software, various ad platforms, and even your payroll system.

Think about every single dollar that helps you land a new customer. These expenses usually fall into a few key buckets:

- Marketing Spend: This is the obvious one. It includes all your paid ad campaigns on platforms like Google, LinkedIn, or Meta. Don't forget to include costs for content promotion or influencer collaborations, too.

- Sales & Marketing Salaries: This is the big one people often miss. You absolutely must include the gross salaries, commissions, and any bonuses for every team member involved in acquisition. This is frequently the largest expense category.

- Essential Tools & Software: Your tech stack isn't free. The monthly or annual fees for tools like your CRM (like Salesloop.io), marketing automation software, and analytics platforms are all part of the cost.

- Creative & Freelance Fees: Did you hire a freelance writer for your blog? A graphic designer for ad creative? An agency to manage your campaigns? All those invoices need to be counted.

Pulling all these different costs together gives you the complete picture of what you’re truly investing. Without this holistic view, your final CAC will be misleadingly low. This is where a tool like Salesloop.io comes in handy—it helps you organize and track specific campaign efforts, making it much easier to connect your spending to actual results. When you’re looking at your B2B sales lead generation strategies, linking tool costs to outcomes is non-negotiable for an accurate analysis.

Defining a Consistent Time Period

Once you know what to track, you need to decide on a timeframe for your analysis. The key here is consistency. You can't compare a CAC calculated over one month to one calculated over an entire year and expect to get meaningful insights.

For most businesses, a quarterly analysis provides the best balance. It's long enough to smooth out random monthly fluctuations but short enough to allow for timely strategic adjustments.

Calculating CAC monthly can be tricky; a single big deal or a front-loaded ad campaign can easily skew the numbers. On the flip side, waiting a full year might mean you don’t spot emerging problems until it's too late. The trick is to pick a period—monthly, quarterly, or annually—and stick with it. This discipline allows you to spot trends and accurately measure the impact of any changes you make.

Beyond your main marketing metrics, having a solid grasp of how to measure social media success is vital. It helps you isolate the true costs and returns from those specific channels, which then feeds back into a more precise overall CAC calculation. This kind of disciplined data collection is the bedrock of a reliable customer acquisition cost.

The Real-World Customer Acquisition Cost Calculation

Now that you've gathered and organized all your data, it's time to put it to work. The actual customer acquisition cost calculation is refreshingly simple on paper, but its power comes from the accuracy of the numbers you plug in. It’s all about making the math a true reflection of your business reality.

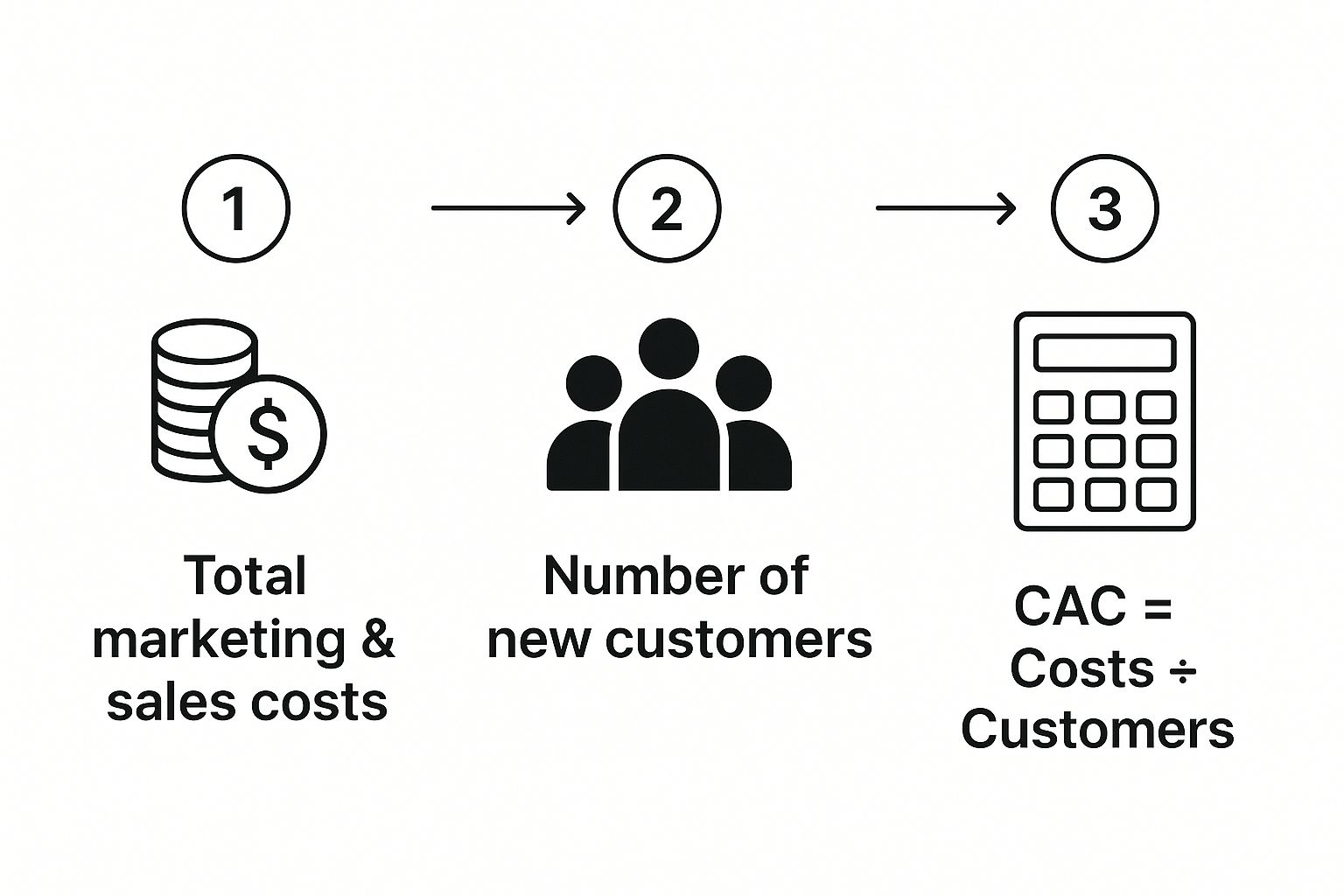

The core formula itself is pretty straightforward:

CAC = Total Sales & Marketing Costs ÷ Number of New Customers Acquired

This simple division gives you the average cost to land a single new paying customer during a specific period. It's the moment of truth where all your spending and effort get distilled into one critical business metric.

The infographic below shows a nice visual breakdown of this flow.

As you can see, it really boils down to two fundamental parts: your total investment and the total number of customers you won. Simple.

A Tangible B2B SaaS Example

Let's move from theory to a more practical scenario. Imagine a B2B SaaS company wants to figure out its CAC for the last quarter (Q3). This means they need to tally up all the associated costs and the final customer count from that period.

Here’s a breakdown of what their quarterly expenses might look like:

- Sales Team Salaries & Commissions: Two sales reps and one manager cost the company $60,000.

- Marketing Team Salaries: Two marketing specialists cost $40,000.

- Digital Ad Spend: Their combined spend on Google Ads and LinkedIn campaigns was $25,000.

- Software & Tools: Subscriptions for their CRM (like Salesloop.io), automation, and analytics tools totaled $5,000.

Add all that up, and you get a total sales and marketing cost of $130,000 for the quarter.

During that same Q3 period, the sales team successfully closed deals with 85 new paying customers.

Now, we just apply the formula:

$130,000 (Total Costs) ÷ 85 (New Customers) = $1,529.41 CAC

So, on average, it cost this SaaS company just over $1,500 to acquire each new customer in Q3.

Navigating the Nuances

Of course, the real world is rarely that neat. Calculations often have tricky parts. For instance, what if one of those sales reps was hired halfway through the quarter? You'd only include the prorated salary for the time they were actually employed. For a rep who started on August 1st, you’d only count two months of their salary in the Q3 calculation, not the full three.

It's the same for one-off expenses, like attending a big trade show. If the event was in Q3, its full cost should be included in that quarter's calculation since it was an investment made during that period to generate leads and customers.

It's also crucial to remember that CAC can vary wildly between industries. You see major differences based on typical sales cycles and product value. For example, some B2B sectors have extremely high acquisition costs; Legal Services average around $749, while Aerospace & Defense can be even higher. You can dig more into these industry CAC benchmarks and their drivers to see where you might stand.

This kind of detailed, honest approach is what turns your CAC from an academic exercise into a powerful diagnostic tool. You end up with a clear number you can actually use to benchmark performance, forecast budgets, and make genuinely informed decisions about your growth strategy.

Finding Your Most Profitable Channels with Granular CAC

A blended, company-wide CAC is great for a big-picture health check, but the real magic happens when you start breaking it down. If you really want to make your marketing budget work harder, you need to calculate your customer acquisition cost for each individual channel.

This is what separates the businesses that scale efficiently from the ones that just throw money at the wall to see what sticks.

It means getting your hands dirty and isolating all the costs and customers tied to specific channels—everything from organic search and paid social all the way to your partner program. Only by looking at each one in a silo can you see what’s actually driving growth.

Attributing Costs and Customers Accurately

First things first, you've got to attribute your costs correctly. This takes a bit more digging than a simple blended calculation. For example, to find your organic search CAC, you can't just look at ad spend, because there isn't any. Instead, you have to tally up all the specific investments that actually fuel that channel.

Here’s how you might break it down for a few common channels:

- Organic Search (SEO): Sum up the prorated salaries of your content and SEO team. Don't forget to add in the cost of your SEO tools (like Ahrefs or Semrush) and any cash you shelled out for freelance writers.

- Paid Social (Meta/LinkedIn): This one's a bit more straightforward. Add your total ad spend on these platforms, the salaries of the specialists running the campaigns, and any costs for creating the ads themselves (think design work or video production).

- Partner Program: Combine any commissions you paid out to partners with the salary of your partner manager and the cost of any software you use to keep the program running smoothly.

Once you have the total cost for a specific channel over a set period, the next piece of the puzzle is attributing the new customers who came from that channel in the same timeframe.

This is where having a well-configured CRM and analytics setup is non-negotiable. It has to be able to tell you, without a doubt, that a customer came from an organic search click or a specific paid ad. You can get a better sense of how this works by understanding the flow of a modern inbound sales funnel.

Key Takeaway: Channel-specific CAC shifts your thinking from "How much does a customer cost?" to "How much does a customer from Google Ads cost versus one from our blog?" This is the question that unlocks smarter budget decisions.

An eCommerce Example in Action

Let's look at how this plays out for an eCommerce brand. In the world of eCommerce, margins can be razor-thin, so understanding channel-level CAC isn't just a good idea—it's essential for survival.

Imagine an online store selling high-end fashion. Their blended CAC might look okay at $75. But when they slice it up by channel, the story changes:

- Instagram Ads CAC: $45

- Google Shopping CAC: $60

- Influencer Marketing CAC: $120

This breakdown is a massive lightbulb moment. It immediately shows that while influencer marketing might be great for getting their name out there, it's a painfully expensive way to get a new customer. Armed with this data, they might decide to pull back on the influencer budget and pump more money into their far more profitable Instagram campaigns.

This kind of precision is what separates the winners from the losers in eCommerce. Average CAC can swing wildly by product category, from around $53 for Food & Beverage to $91 for Jewelry. Knowing your specific channel costs within these categories is what keeps you profitable.

If you're curious, you can check out a deeper breakdown of average eCommerce CACs across different industries to see how you stack up. This granular view empowers you to double down on your money-makers and rethink the channels that are just draining your budget.

Proven Strategies to Lower Your Customer Acquisition Cost

Figuring out your customer acquisition cost is just the first step. The real magic happens when you start actively pushing that number down without sacrificing growth. Let's skip the generic advice. These are the tactics I've seen make a real impact, getting more bang for every single marketing dollar.

The most direct way to slash your CAC is by improving your conversion rates. Think about it: if your landing page only converts at 2%, getting that up to 4% literally cuts your cost per acquisition in half for that campaign. You haven't spent a penny more on ads, but you've doubled your results. That's the power of Conversion Rate Optimization (CRO).

Refine Your Funnel and Targeting

Start by putting every step of your marketing funnel under a microscope. Where are people bailing? A/B testing is your best friend here. Tweak headlines, experiment with different calls-to-action (CTAs), and play with page layouts. You'll quickly discover what actually gets your audience to click.

Sharpening your ad targeting is another quick win. Instead of casting a wide, expensive net, get laser-focused on the audiences who are ready to buy. Use negative keywords in your search campaigns to weed out the tire-kickers and build lookalike audiences on social media based on your absolute best customers. This makes sure your budget goes toward prospects who are genuinely likely to convert.

Key Takeaway: Lowering your CAC isn't just about spending less; it's about spending smarter. Focusing your resources on high-conversion activities and high-intent audiences delivers a much better return on every dollar.

Build Sustainable Acquisition Channels

Paid ads get you results fast, I get it. But the leads dry up the second you turn off the spend. For real, long-term growth, you need to invest in channels that build their own momentum.

- Content & SEO: This is the classic flywheel. Creating genuinely helpful blog posts, in-depth guides, and free tools that solve your audience's problems will attract qualified organic traffic for months, even years. It takes effort to get it spinning, but once it's going, it delivers a steady stream of low-cost leads.

- Customer Referral Programs: Your happiest customers can be your most effective sales team. A simple, rewarding program that gives them a kickback for bringing in new business can quickly become a super-efficient and cheap acquisition channel.

- Automation: When you automate lead generation with the right tools, you free up your team from mind-numbing manual work. They can then focus on what they do best—building relationships and closing deals—which makes their salary cost far more efficient.

Of course, having a solid financial footing makes it easier to invest in these longer-term plays. Smart practices, like those outlined in guides on How to Improve Cash Flow, give you the stability to build for the future.

It's also crucial to remember that CAC isn't the same everywhere. As you expand, regional costs can change the entire game. In 2024, for example, North America had the highest average Cost Per Install at $5.28—a common stand-in for app marketing CAC. Compare that to EMEA at $1.03 or APAC at just $0.93, and you see why a one-size-fits-all budget is a recipe for disaster. Localizing your strategy isn't just a good idea; it's essential for survival.

Common Questions About Calculating CAC

As you start digging into your customer acquisition cost, a few questions almost always pop up. These are the little details that can trip you up and throw your numbers off if you're not careful. Let's clear the air on the most common sticking points.

CAC vs. CPA: What's the Difference?

One of the first hurdles people run into is the confusion between Customer Acquisition Cost (CAC) and Cost Per Acquisition (CPA). They sound similar, but they're measuring two very different things.

- CAC is laser-focused. It measures the total cost to land a new paying customer. Think of it as the ultimate report card for how efficiently your sales and marketing efforts turn into actual revenue.

- CPA is a much broader term. It can measure the cost of pretty much any action you want someone to take—signing up for a free trial, submitting a lead form, subscribing to a newsletter, you name it.

Basically, your CAC is a very specific, high-stakes kind of CPA. You might have a great CPA of $5 for a new lead, but if it takes 100 of those leads to get one paying customer, your CAC is actually $500.

What About Freemium and Trial Users?

So, how do free trial or freemium users fit into the picture? This is where a lot of businesses get it wrong.

When you're calculating a pure customer acquisition cost, you should only count users who convert to a paid plan in your "New Customers Acquired" total.

It's tempting to include everyone, but the costs to acquire all users (both free and paid) go into your total expenses, while the denominator must only include those who start paying you. This gives you the real, unvarnished truth about the cost to acquire a customer who actually impacts your bottom line.

What's a good LTV to CAC ratio?

The gold standard for a healthy LTV (Lifetime Value) to CAC ratio is generally considered 3:1 or higher. This means for every dollar you spend to acquire a customer, you're getting at least three dollars back over their lifetime. A 1:1 ratio means you're just breaking even (and probably losing money once you factor in all business costs), while a sky-high ratio like 5:1 might mean you're underinvesting and leaving growth on the table.

Ready to get a crystal-clear view of your outreach performance and start optimizing that CAC? Salesloop.io gives you the detailed analytics you need to connect your campaign costs to real-world results. Start making data-driven decisions by visiting https://salesloop.io to see how our platform can streamline your entire B2B sales process.