Picture this: you have a way of knowing which companies are actively looking for a solution just like yours. Not just kicking tires, but seriously researching. You know this even before they've hit your website or filled out a single form.

That’s the magic behind B2B intent data. It’s like seeing the digital body language of your prospects, showing you exactly who’s in-market and ready to talk, right now.

So, What Is B2B Intent Data, Really?

Think about the old way of doing sales. It was a lot like fishing with a single line in a massive ocean. You’d cast your bait—maybe a contact form or a whitepaper—and just wait for a lead to bite.

B2B intent data is the upgrade to a high-tech sonar system. Suddenly, you can see exactly where the schools of fish are swimming, what they’re interested in, and just how hungry they are. You stop waiting and start navigating directly to the action.

This intel is gathered by tracking online research happening across millions of websites, industry forums, and publisher networks. It pinpoints when employees from specific companies start digging into topics, keywords, or even your direct competitors.

The Big Shift: From Reactive to Proactive

This completely flips the script for your sales and marketing teams. You’re no longer stuck in a reactive mode, waiting for leads to stumble upon you. Instead, you can proactively find accounts that are showing all the classic signs of buying intent out on the open web.

This shift allows for outreach that is incredibly relevant and perfectly timed.

At its core, B2B intent data lets you find buyers who are deep in their research journey but might not even know you exist yet. It gives you the chance to step in with the right message at the exact moment they need to hear it.

And this isn't just about finding one interested person. It's about seeing the collective interest bubbling up from the entire buying committee within a target company. For a deeper dive into the nuts and bolts, this glossary entry on B2B Intent Data is a great resource.

How Intent Data Transforms Sales and Marketing

This kind of intelligence has a massive ripple effect across any go-to-market strategy. The table below breaks down some of the biggest advantages.

| Benefit | Impact on Business |

|---|---|

| Smarter Account Prioritization | Sales teams stop wasting time on cold leads and focus their energy on accounts that are actively signaling they're ready to buy. |

| Truly Personalized Outreach | Knowing an account's research topics lets you craft messages that speak directly to their current challenges and interests. |

| Tighter Sales & Marketing Alignment | Both teams operate from the same playbook, creating a unified and powerful strategy to engage and win high-value accounts. |

Essentially, it gives teams a shared "source of truth" to rally around, ensuring everyone is pulling in the same direction.

A Proven Playbook for Growth

The proof is in the numbers. It's not just a trend; it's a fundamental strategy that gets results.

Recent studies show that 96% of B2B marketers report success in meeting their goals when they use intent data. Even more telling, a staggering 98% of marketers now consider this data absolutely essential for their demand generation programs.

At the end of the day, B2B intent data turns the art of sales into a science of timing and relevance. It provides the crucial context needed to transform a cold, interruptive call into a warm, welcomed conversation that lays the groundwork for a real customer relationship.

How Intent Data Is Sourced and Analyzed

To really get what makes B2B intent data so powerful, you have to understand where it comes from. These valuable buying signals aren't just pulled from thin air; they're carefully gathered from a few key sources, with each one giving you a different piece of the puzzle. It’s a bit like a detective collecting clues from various spots to build a case.

The whole process starts by collecting information from three main categories. Each offers a different level of insight and scale, and the sharpest strategies blend them together to paint a full picture of an account's buying journey.

First-Party Data: The Home-Field Advantage

First-party data is the information you collect yourself, right from your own digital properties. This is your "home-field advantage" because you own it, you control it, and it comes straight from prospects who’ve already shown some interest in your brand.

This is the data generated on your own turf. Think about things like:

- Website Behavior: Tracking which pages someone visits, how long they stick around, and what resources they download.

- CRM History: Looking at past interactions, support tickets, and sales notes logged in your system.

- Marketing Automation: Monitoring email opens, click-throughs, and who showed up for your last webinar.

While first-party data is incredibly high-quality and accurate, it has one major limitation. It only tells you about accounts that already know who you are, leaving a massive blind spot for all the prospects who are actively shopping but just haven't stumbled across you yet.

Second-Party Data: A Trusted Introduction

Second-party data is basically someone else's first-party data that you get directly from them, usually through some kind of partnership. A perfect example is co-hosting a webinar with a non-competing company in your space. The attendee list you both share afterward? That's gold-standard second-party data.

This approach opens the door to a fresh, relevant audience that’s already been vetted by a partner you trust. It strikes a nice balance between quality and scale, but it all hinges on your ability to build those strategic relationships.

Third-Party Data: The Market-Wide Radar

This is where the true scale of B2B intent data really shines. Third-party data is collected and pieced together from a massive network of external sources, giving you a market-wide radar to see what’s happening way beyond your own website.

Providers gather this information from millions of different online touchpoints, including:

- Publisher Networks: Tracking who is reading what across thousands of B2B publications, industry blogs, and news sites.

- Review Platforms: Seeing which companies are comparing vendors or researching solutions on sites like G2 or Capterra.

- Public Forums: Watching discussions and questions unfold on community sites where professionals are looking for advice.

By analyzing this vast ocean of data, providers can spot when a company suddenly spikes in research around specific topics, products, or even your competitors. That surge is the core signal that an account is moving into an active buying cycle.

The real magic, though, is in the analysis. Raw behavioral data is just noise. It takes a combination of artificial intelligence and machine learning to turn it into something your sales team can actually use. These systems dig through trillions of data points every month to separate the casual browsers from the serious buyers.

Understanding the principles behind different data analysis methods helps you appreciate what's happening under the hood. AI algorithms look for patterns, score how intense the interest is, and connect anonymous online activity back to specific companies. This is how a sea of digital footprints gets transformed into a clean, prioritized list of in-market accounts your team can call with confidence.

Choosing Your Data: First-Party vs. Third-Party

When you start digging into B2B intent data, you quickly realize that not all signals are created equal. Where your data comes from drastically changes how you can use it, its scale, and its strategic value. The choice really boils down to two main buckets: first-party and third-party data. Each plays a totally different but equally important role in a solid go-to-market strategy.

Here’s a simple way to think about it.

First-party data is like hosting a party at your own house. You know exactly who shows up, what they talk about, and which rooms they wander into. The information is intimate and high-quality, but it’s limited to people who already know your address.

Third-party data, on the other hand, is like having a city-wide map showing you where crowds are gathering—at public squares, competitor events, or industry meetups. You suddenly discover whole new groups of interested people you never would have found on your own. It's a map to a much, much larger audience.

The Power Within Your Walls: First-Party Data

First-party data is all the information you gather directly from your audience using your own assets. This is that "home-field advantage" I mentioned. It’s the behavioral breadcrumbs left across your:

- Website analytics (page views, time on page, content downloads)

- CRM system (past interactions, deal stages, notes)

- Marketing automation platform (email opens, webinar sign-ups)

The biggest win here is accuracy and relevance. These are real people from real companies interacting directly with your brand. This data is pure gold for understanding and nurturing the accounts already in your orbit, helping you guide them through your sales funnel much more effectively.

The catch? Its scope is limited. It can’t show you the huge market of potential buyers who haven’t stumbled upon you yet.

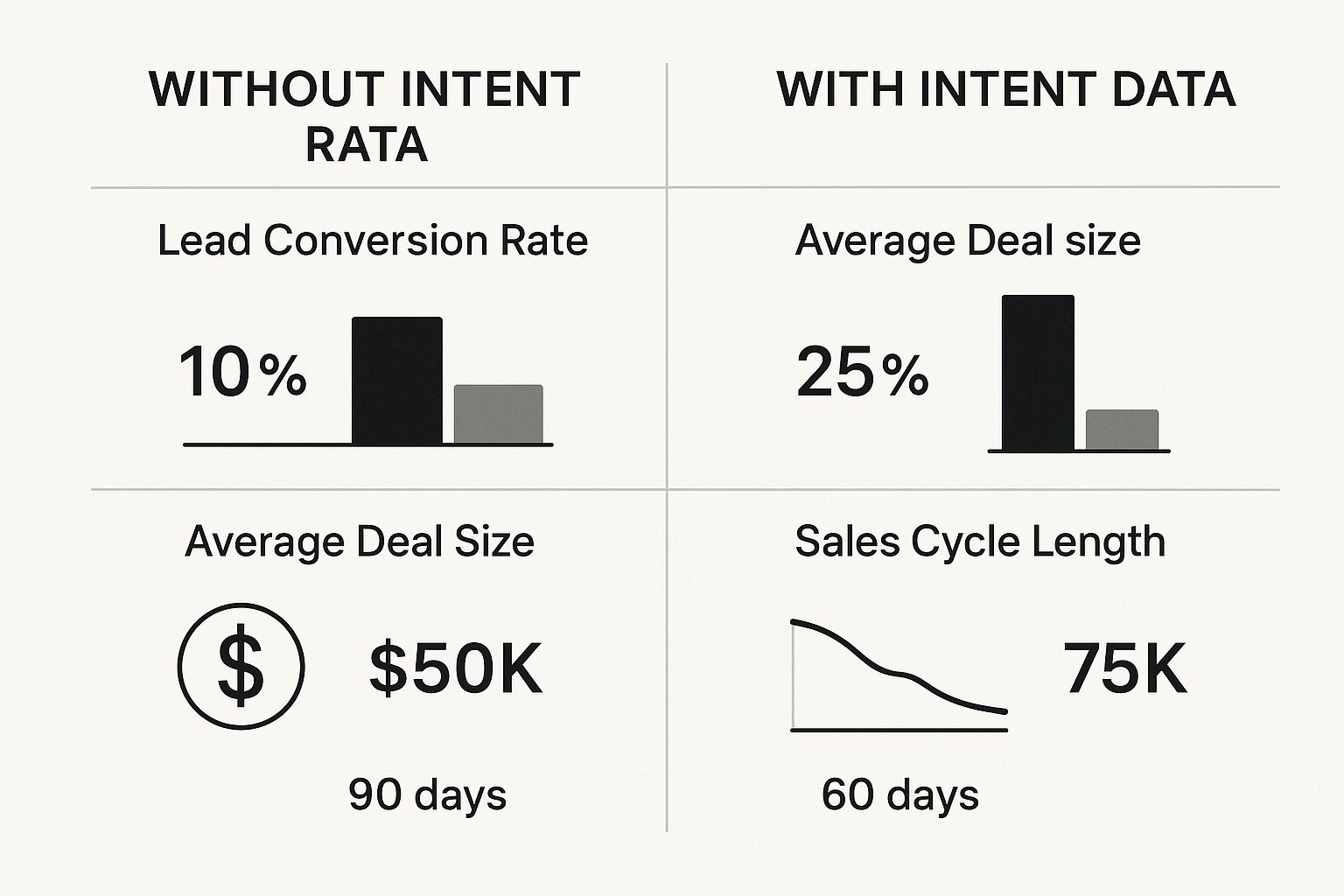

This infographic really drives home the business impact a well-rounded intent data strategy can have on the sales metrics that matter most.

The numbers don't lie. Teams armed with these kinds of signals convert more leads, close bigger deals, and do it all in a fraction of the time.

Expanding Your Horizons With Third-Party Data

While first-party data helps you engage the prospects you know, third-party data is how you find all the ones you don't. This is your engine for net-new growth and getting true visibility into your market.

Third-party providers pull behavioral signals from a massive network of sources across the web—think publisher sites, software review platforms, and online forums. By crunching all this information, they can pinpoint which companies are actively researching specific topics, keywords, and even your competitors.

This market-wide view is what makes B2B intent data a game-changer for account-based marketing (ABM). It lets you build target account lists based on what companies are doing right now, not just on static info like industry or company size.

This approach is absolutely essential for uncovering hidden opportunities and getting in front of potential buyers early in their journey—often before they’ve even decided on a shortlist of vendors.

For a deeper dive into putting these insights into action, check out our guide on modern strategies for B2B sales lead generation. When you know who is actively searching for a solution, you can stop spraying and praying and instead focus your efforts where they'll actually make a difference.

A Practical Comparison for Your Strategy

Look, choosing between first-party and third-party data isn't an "either/or" decision. It's a "when and why" decision. The most successful teams use both. First-party data tells you how to nurture your known accounts, while third-party data fuels the engine to find new ones.

To help you figure out where to focus your resources, here’s a straightforward comparison across the most important attributes.

Comparing First-Party and Third-Party Intent Data

This table breaks down the key differences to help you decide which data type best fits your immediate strategic goals.

| Attribute | First-Party Data | Second-Party Data | Third-Party Data |

|---|---|---|---|

| Accuracy | Extremely high. You collected it yourself from direct interactions with your brand. It's verifiable and trustworthy. | High, but depends on the partner's data quality. It's essentially someone else's first-party data. | Varies by provider. Accuracy hinges on their data sources and how rigorously they validate everything. |

| Scale | Limited. It's capped by your existing audience and website traffic. It can't find prospects who don't know you exist. | Moderate. It extends your reach to a partner's audience, but is still confined to that specific ecosystem. | Massive. It gives you a view into the research activities of millions of companies across the entire web. |

| Ideal Use Case | Perfect for lead scoring, nurturing existing leads, and spotting upsell or cross-sell opportunities with current customers. | Great for strategic partnerships, co-marketing campaigns, and reaching a specific, highly-relevant adjacent audience. | The go-to for new account discovery, building ABM target lists, competitive intelligence, and fueling demand gen at scale. |

Ultimately, blending these data types creates a powerful feedback loop. Third-party data brings new, in-market accounts to your front door, and your first-party analytics track how they engage once they step inside. This synergy is what makes your sales and marketing efforts both efficient and effective.

Putting Your Intent Data Into Action

Collecting and analyzing B2B intent data is only half the battle. The real magic happens when you put those insights to work, turning abstract signals into real sales and marketing wins. This is where strategy meets execution—and it completely changes how you find, engage, and close new customers.

Activating intent data isn't about adding another complicated process to your team's plate. It’s about making every single thing you already do smarter, more targeted, and way more effective. It gives your go-to-market team the "why" and "when" for every move they make.

The goal is simple: stop guessing who's interested and start taking specific, timely actions that speak directly to their needs. This is what separates the high-performers from the teams still waiting for leads to fall into their lap.

Prioritize Accounts for ABM and Sales Outreach

Right out of the gate, the biggest win from B2B intent data is smarter account prioritization. Instead of blasting your entire target account list (TAL) with the same energy, you can now see which accounts are "hot" at this very moment.

Think of it like an airport departure board. Sure, all the flights are listed, but only a handful are flashing "Now Boarding." Intent data is that flashing light, telling your sales team exactly where to focus their attention for immediate results.

By layering intent signals over your existing account lists, you can create a dynamic, tiered system. Accounts showing a high volume of relevant research—what providers often call a "surge"—move to the top of the queue for immediate outreach.

This simple shift ensures your most valuable resource—your reps' time—is spent on conversations that have the highest chance of success. Of course, as you get your reps focused on the right accounts, you need to track what's working. A good guide to sales activity tracking is essential to make sure your new strategies are paying off.

Personalize Sales and Marketing Messaging

Generic outreach is the fastest way to get your email deleted. Intent data is your secret weapon for crafting messages that feel personal, relevant, and genuinely helpful.

When you know an account is actively researching "cloud data migration" or "cybersecurity compliance," you can ditch the vague, "just checking in" intros. You get to lead with real value, offering content, case studies, or questions that hit on exactly what's on their mind.

Here’s how that plays out in the real world:

- For Sales: An SDR's email transforms from generic to specific. Instead of a bland intro, they can say, "Saw your company is exploring cloud data migration solutions. We recently helped [Similar Company] cut their migration time by 40% with our platform."

- For Marketing: Nurture campaigns become hyper-relevant. You can serve up blog posts, webinars, and whitepapers that directly address the pain points you know they're trying to solve, based on intent topics.

This level of relevance proves you've done your homework and respect their time, which dramatically boosts your chances of getting a reply.

Inform Your Content and Ad Strategy

Your content strategy shouldn't be a guessing game. Intent data gives you a direct line into what your market actually cares about right now, so you can stop creating content in a vacuum and start meeting real-time demand.

See a sudden spike in research around a competitor or a specific problem? That’s your cue. It’s a clear signal to create a blog post, a comparison guide, or a webinar that tackles that exact topic head-on.

The same logic completely transforms your paid advertising. Running digital ad campaigns without intent targeting is like putting up billboards on a random highway—you're paying for eyeballs, but most of them belong to people who will never, ever buy from you.

With B2B intent data, you can build hyper-targeted ad audiences made up only of companies showing active buying signals. This is a game-changer for platforms where B2B buyers do their research. The market is already moving this way, with social media ad spending projected to hit over $256 billion globally in 2025. It's no surprise when you see that about 70% of marketers report a positive ROI from LinkedIn ads—it's a prime channel for these highly targeted campaigns.

By focusing your ad spend exclusively on in-market accounts, you cut out the waste. Your budget starts driving qualified traffic and predictable pipeline, turning your ad campaigns from a cost center into a revenue-generating machine.

Selecting the Right Intent Data Partner

Choosing to invest in third-party B2B intent data is a big move. The market is packed with providers, and they all promise to deliver a pipeline full of gold. But let's be real—not every platform will be the right fit for your strategy. Making the smart choice means you have to look past the flashy sales pitches and size up vendors on a few critical points.

Think of it like hiring a key team member. You wouldn't bring on a new strategist without checking their references, digging into their methods, and making sure they gel with your company culture, right? The same logic applies here. You aren't just buying a list of names; you're investing in a partnership that should drive real, measurable revenue.

Evaluate Data Sourcing and Accuracy

The first question you have to ask any potential partner is simple: where does your data come from? A provider’s sourcing methods are directly tied to the quality and reliability of the signals you'll get. The best platforms don’t just pull from one or two places; they aggregate data from a wide, diverse range of sources, like publisher networks, software review sites, and niche online communities.

A broader data pool gives you much better market coverage and helps eliminate blind spots. When you're talking to potential partners, get specific:

- Data Sources: Ask them which publisher networks or co-ops they're a part of. Transparency is a really good sign.

- Accuracy Guarantees: How do they connect anonymous online activity back to a specific company? Push them on their methods for handling remote workers and shared office spaces to make sure their accuracy claims hold up.

- Data Freshness: Intent signals have a short shelf life. Last week’s buying signal might be yesterday’s news. Find out how often their data is refreshed—daily updates should be the absolute minimum.

Choosing a provider is a high-stakes decision. You need a partner whose data is not just comprehensive but also clean, current, and compliant with privacy standards like GDPR and CCPA.

Ensure Seamless Tech Stack Integration

Here's the hard truth: even the best data is useless if it’s trapped in a silo, completely disconnected from the tools your team lives in every day. So, a massive factor in your decision has to be how well a provider’s platform plays with your existing tech stack.

You're looking for native, seamless integrations with your core systems, especially your CRM (like Salesforce) and marketing automation platform (like HubSpot). When data flows automatically between systems, it gives your teams the power to act fast. Your reps can get real-time alerts on surging accounts right inside their CRM, and marketing can trigger personalized nurture campaigns without any manual lift.

Poor integration just creates friction and kills all that momentum, turning your shiny new data into a frustrating, time-sucking task.

Look Beyond Data to Strategic Support

Finally, remember that a top-tier intent data partner brings more to the table than just raw data; they offer strategic support to help you actually win. This is a huge deal, especially when you're just getting started. A good partner will sit down with you to define your initial intent topics, help you set up workflows, and provide ongoing guidance on how to interpret the signals you’re seeing.

This kind of partnership is especially crucial when you look at adoption rates. While about 99% of large enterprises already use intent data, overall B2B adoption is hovering closer to 25%. That gap tells a story: major corporations have the resources to figure it all out, but smaller firms can gain a massive advantage by leaning on a partner who acts as a guide. You can learn more about how companies are leveraging these statistics on MyShortlister.com.

The support you get can make or break your ROI. It ensures your team not only has access to powerful data but actually knows how to use it effectively in your sales and marketing programs, like enriching your social selling strategies for B2B sales.

Common Mistakes to Avoid

Getting your hands on B2B intent data can feel like you’ve suddenly unlocked a sales and marketing superpower. But with great power comes… well, a few new ways to stumble. Just having the data isn’t a golden ticket to success. What really separates the high-flyers from the teams that never see a return is how they put it to work.

One of the most common missteps is treating intent data like a magic wand. Teams get swept up in the excitement of a new flood of information but completely forget to build a solid process around it. This inevitably leads to reps chasing flimsy signals or getting buried under a mountain of alerts. Before you know it, they lose faith in the tool and slide right back into their old, less effective habits.

Intent data is a powerful tool, not a silver bullet. Its value is unlocked through a well-defined strategy, clear processes, and realistic expectations—not by simply turning it on and hoping for the best.

This strategic gap is a surprisingly common problem. Despite seeing positive results, a staggering 42% of B2B teams admit that creating a comprehensive strategy for their intent data is a major hurdle. Even with that complexity, 97% of marketers agree these insights give their brand a serious competitive edge, as highlighted in this in-depth look at buyer intent statistics from zymplify.com.

Ignoring Crucial Context

Another classic pitfall is looking at intent signals in a vacuum. Sure, a spike in research from a company seems promising on the surface, but without any context, it’s just a lonely data point.

Is the person doing the research an intern on a fact-finding mission or a C-level decision-maker with a budget? Does the company even fit your ideal customer profile (ICP)?

To avoid chasing ghosts, you have to enrich those intent signals with other types of data:

- Firmographic Data: Layer in details like industry, company size, and revenue to make sure the account is a good fit from the start.

- Technographic Data: Get a snapshot of their current tech stack. Is your solution compatible? Can it replace a competitor they’re already using?

- First-Party Data: Always cross-reference signals with your own CRM. Do you already have a relationship with them? Is there a conversation history you’re missing?

Creating Information Silos

Finally, one of the most critical—and frustrating—errors is poor integration with the tech you already use.

When your intent data lives on a completely separate platform, it becomes a chore for reps to access and use. This creates information silos where your most valuable insights go unseen and unactioned, which pretty much defeats the whole purpose of the investment.

The solution is simple: make sure your intent data provider plugs right into your CRM and sales engagement tools. When a hot account is flagged, the alert and all its juicy context should pop up directly within the systems your team lives in every day. This kind of automated workflow is what turns raw data into timely, relevant action. You can see how easily automation can go wrong by reading about these common LinkedIn automation mistakes and how to fix them.

Answering Your Top Questions

As you start thinking about using B2B intent data, a few practical questions always pop up. It's totally normal. Let's tackle these common queries head-on so you can move forward with confidence and build a program that actually works.

How Is Intent Data Different From Website Analytics?

This is a great question, and the distinction is crucial.

Think of it this way: your website analytics are like your own storefront's security camera. They tell you who walked into your store, which aisles they browsed, and what they picked up. It's fantastic first-party data for understanding accounts that already know who you are.

But B2B intent data is like having a view of the entire shopping mall. It shows you what your ideal customers are researching across the whole web—competitor sites, industry blogs, review platforms, you name it. It uncovers buyers who are in-market for a solution like yours but might not have even heard of your brand yet. This gives you the power to find them first.

Can We Use Intent Data on a Small Budget?

Absolutely. You don't need a massive budget to get started.

The best—and cheapest—place to begin is with your own first-party intent data. It's essentially free. Dig into your website traffic, see who's engaging with your content, and look at your CRM history. Just by analyzing the accounts already showing interest, you can start prioritizing your outreach much more effectively.

When you're ready for third-party data, most providers offer flexible starter packages or pilot programs. This lets you test the waters with a smaller, focused campaign, prove the ROI, and build a case for a bigger investment down the road.

How Do We Measure the ROI of Intent Data?

To really see the impact, you need to set a baseline before you start. Know your numbers now so you can compare them later. The most important KPIs to track are the ones that directly tie to revenue:

- Higher Conversion Rates: Are more of your cold emails and calls turning into qualified meetings? This is a direct signal that you're reaching the right people at the right time.

- Increased Pipeline Velocity: Are deals moving through your sales funnel faster? When you engage accounts that are actively researching, you cut down the time from first touch to closed-won.

- More Net-New Opportunities: Are you booking meetings with target accounts that were previously ghosts? This shows you're successfully uncovering new, in-market buyers you would have otherwise missed.

Ready to turn those intent signals into real conversations? Salesloop.io helps you build automated outreach campaigns that actually get results. See how our platform can accelerate your pipeline growth at https://salesloop.io.